Implications of the ACA, New Care Models for Pharmacists

Orlando—Conversations related to accountable care organizations (ACOs) and other emerging models of care rarely address pharmacists or medication management. Paul Baldwin, BS, principal, Baldwin Health Policy Group, LLC, discussed pharmacists’ involvement in ACOs and other care models with an overview of the Patient Protection and Affordable Care Act (ACA) during a session at the ASCP meeting.

“What did we imagine, even 10 years ago, that long-term care [(LTC)] would look like in 2014?” he asked attendees.

The LTC pharmacy industry annual revenues have been relatively flat over the past several years, said Mr. Baldwin, referring to the IBISWorld Institutional Report released in March 2014 that estimated $13.6 billion in revenue for institutional pharmacies. The report noted that the industry has experienced some decline in recent years due to receding Medicare and insurance reimbursement rates. He said the industry’s reliance on Medicare for revenue is a vulnerability of the LTC pharmacy business model, since 90% of the industry’s revenue comes directly or indirectly from Medicare and Medicaid.

Medicare Part D drug expenditures are going to skyrocket in the coming years, with $171.2 billion projected for 2023, according to Mr. Baldwin. The Medicare Drug Benefit has grown larger and more popular since its kickoff in 2006.

Among the notable changes are:

• 70% of Medicare beneficiaries are enrolled in the drug plan and growth is expected to continue

• 10 years ago, Medicare managed care plans had trouble breaking into 10% market share; now the momentum has shifted and the trend line is moving toward Medicare Advantage

• Medicare Part D sponsorship continues to consolidate around bigger sponsors; currently, 10 of the largest sponsors cover 75% of all enrollees

• Preferred networks are becoming the standard and are currently in 72% of prescription drug plans versus 50% in 2011

“Pharmacy network is a battle that continues to be fought between pharmacy benefit managers and retail pharmacies,” said Mr. Baldwin.

Prior to 2006, Medicaid was the chief revenue for LTC pharmacy services. A disproportionate share of Medicaid resources (45%) is spent on a small number of beneficiaries (6%), and many of these beneficiaries are nursing home residents. He said states have begun to respond by moving aggressively to impose some type of management on the LTC population. States have traditionally allowed the LTC population to continue in a fee-for-service environment, but that is changing. This year, 26 states will have implemented managed long-term care services and supports. Furthermore, Medicaid LTC costs are projected to grow from $120 billion in 2013 to $205 billion in 2022, said Mr. Baldwin.

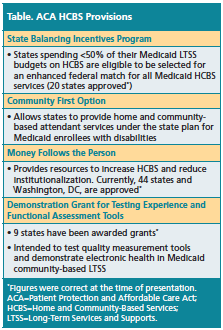

The ACA has several provisions that have the potential to change the LTC industry, including that the ACA has expanded Home and Community-Based Services (HCBS), which focuses on creating Medicaid alternatives to nursing homes for the care of residents requiring assistance normally provided in nursing facilities (Table). He said federal and state policy is now focused on avoiding nursing homes as “the default setting” for LTC.

In addition to HCBS incentives, the ACA created ACOs to encourage healthcare providers to voluntarily band together to improve quality and reduce costs. Mr. Baldwin said most ACOs are organized around hospitals, and of the original 32 Pioneer ACOs, only 19 remain in the program. He told attendees, “ACOs will continue to evolve, and in order to become relevant in this space, you will need to learn as much as possible about the ACO’s approach to quality and savings and determine where your capabilities can add value.”

Bundled payments are another tool to facilitate cooperation among providers. The Centers for Medicare & Medicaid Services is promoting the bundled payment initiative, where a global payment will be made for certain diagnoses. He said the initiative includes 4 models for care—2 that are exclusively acute care and 2 that include post-acute care. “Success in this environment requires establishing a partnership with a participating skilled nursing facility [(SNF)],” explained Mr. Baldwin. “Understanding the specific [diagnosis-related groups] involved and how your pharmacy can contribute to success are critical to winning in this environment.”

Unlike other ACA provisions, readmission penalties for hospitals are designed to create a disincentive to provide lower quality of care, according to Mr. Baldwin. This program, which is not voluntary for many hospitals, focuses on specific conditions for which beneficiaries are readmitted within 30 days of discharge. The penalties will be 3% of the diagnosis-related group payment in fiscal year 2015.

“Working with your [SNFs] and directly with hospitals to improve the opportunities to avoid readmission is the best way to engage in this program,” he said.

Mr. Baldwin ended the session by discussing potential opportunities for consultant pharmacy outside of government-sponsored care. “While we have traditionally focused on the 7% of seniors residing in some sort of institutional setting, we may be losing sight of the fact that 93% of seniors do not reside in an institution,” he said. Although these seniors have a drug benefit, not all of them are entitled to the benefits of medication therapy management and a comprehensive medication review. Employee benefits are an example of an opportunity for consultant pharmacy outside of the Medicare and Medicaid arena. He said elder care benefits have become a staple of employee benefits at large companies and are increasingly popular at smaller companies.

“Perhaps, the most important decision we have to make is to change our mindset about what we do,” concluded Mr. Baldwin.—Eileen Koutnik-Fotopoulos