ADVERTISEMENT

ICER: Does the Industry Take Cost-Effectiveness Seriously?

As the national drug pricing tug-of-war continues, use of value frameworks to help inform pricing or coverage decisions is gaining popularity. In 2015, four organizations—Institute for Clinical and Economic Review (ICER), American Society of Clinical Oncology, Memorial Sloan Kettering, and National Comprehensive Cancer Network—rolled out value framework initiatives aimed at helping stakeholders assess the value of drugs. For value-based price benchmarks to be effective it must take into consideration the perspectives of various stakeholders including payers, manufacturers, providers, patients, and society.

As the national drug pricing tug-of-war continues, use of value frameworks to help inform pricing or coverage decisions is gaining popularity. In 2015, four organizations—Institute for Clinical and Economic Review (ICER), American Society of Clinical Oncology, Memorial Sloan Kettering, and National Comprehensive Cancer Network—rolled out value framework initiatives aimed at helping stakeholders assess the value of drugs. For value-based price benchmarks to be effective it must take into consideration the perspectives of various stakeholders including payers, manufacturers, providers, patients, and society.

ICER’s value assessment framework is viewed by some stakeholders as influential on US health care. This led First Report Managed Care to take a closer look at ICER and its impact on formulary decisions-makers.

ICER, a Boston-based independent nonprofit organization, provides comprehensive clinical and cost-effectiveness analysis of medical tests, treatments, and delivery system innovations to inform payer coverage and reimbursement decisions. In 2015, ICER launched the Emerging Therapy Assessment and Pricing (ETAP) program aimed at evaluating new drugs close to FDA approval. The two major goals of the ETAP program are (1) authoritative assessment and price benchmark reports, (2) public engagement with all stakeholders to enhance legitimacy, dissemination, and impact.

Industry Use of ICER Reports

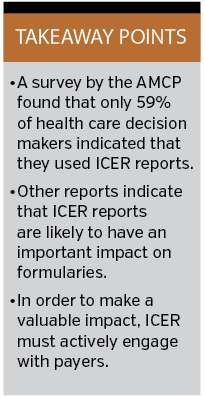

Dymaxium Inc, using the Academy of Managed Care Pharmacy eDossier System, analyzed US payers’ use of ICER reports. A 2016 survey of decision makers found that 59% of respondents indicated that they, or their organization, had used drug assessment reports that ICER released in the last year as part of the drug evaluation/coverage policy development process. As for when reports are used, most said during the drug research process (64%) and the P&T review phase (56%). A key limitation cited by 49% of respondents was the timeliness of the reports.

Recently, ICER and the Department of Veteran Affairs (VA) Pharmacy Benefits Management Services office announced a partnership to facilitate their integration of ICER reports into the VA’s formulary management process in order to allow negotiations for lower priced drugs.

“From VA’s perspective, what is unique about the collaboration arrangement is that VA and ICER staff can engage each other on issues of mutual interest,” VA spokesperson told First Report Managed Care. “ICER itself determines the products it will consider for review. VA reviews all new molecular entities and prioritizes those reviews based on the needs of the veteran population. VA’s focused on assessing value of treatment options and ensuring drugs are used appropriately for patients.”

Stakeholder Perspectives

First Report Managed Care spoke with stakeholders for their perspectives on ICER, and the potential for an “ICER effect” in the United States.

Their views were mixed on whether ICER can serve as an official value benchmark system. “More likely than not ICER will/can serve as the value benchmark system. The approach is not new or novel—we have been using our own version of comparative cost per outcome to make indirect comparisons across drugs for a long time,” said Jeffrey Dunn, PharmD, MBA, chief clinical officer/senior vice president, VRx Pharmacy Services. “Utility will depend on payers and providers jointly agreeing not to prescribe/cover if the cost per outcome is too high (assuming we have other options).”

Norm Smith, president, Viewpoint Consulting Inc, said it depends on what assumptions ICER are using, noting that they are moving from using “sticker price” for the drug to the net price. “Most manufacturers are loathe to make that net price public, since it is likely to be the lowest price available to the market. ICER is also a creature of the health insurance industry, and there are high levels of distrust from manufacturers.”

Mitch DeKoven, MHSA, principal, health economics and outcomes research, real world insights, QuintilesIMS, added that critiques of ICER and other value benchmark systems are underway. “It remains to be seen whether there can/should be an official benchmark system and what that might look like and moreso, how stakeholders would incorporate it into their decision making.”

Another discussion point among stakeholders is if ICER data is being used to help formulate drug pricing and if their cost-effective data is having an impact on spending. “ICER is one decision support tool, along with input from local specialists and from internal drug information resources. I know some plans are leaning on it more than others, and it’s ‘name recognition’ is becoming greater every year. I have also seen where manufacturers are letting ICER become a reference tool in internal discussions, and that’s where it may have the greatest long-term impact,” according to Mr Smith.

In a recent Value and Outcomes Spotlight article, Allen Lising, managing director of Dymaxium Inc, and colleagues, concluded, “It is clear from the evidence gathered to date that the existence of ICER assessments is likely to have an important impact on formulary decision-making processes in the US. That is, we do expect an ‘ICER effect’”.

Mr Smith noted that several factors will impact the adoption of ICER reports. For example, in the United States, “local market practices may impact the acceptance of ICER methodologies in some markets more than others. Perhaps a bigger question will be the impact of ICER’s methodologies on the manufacturer’s pricing of new products. Will prices (and rebating strategies) be adjusted to gain a positive response from ICER?”

Mr DeKoven added, “As reports from ICER, and elsewhere, become more readily available and timely for decision makers, you can anticipate additional scrutiny and occasional formulary decisions to be based on these reports.

Story continues on page 2

ICER Value Assessment Framework Updates

In June, ICER released final updates to its value assessment framework for 2017-2019. ICER plans a regular update cycle for its value framework every two years. According to a press release, key changes, updates, and restatements of current methods include:

• The range of incremental cost-effectiveness ratios used to calculate the ICER value-based price benchmarks will remain $100,000 to $150,000 per additional quality adjusted life-year (QALY); however, a broader range of $50,000 to $175,000 per QALY will be used for voting by independent appraisal committees at ICER public meetings.

• Prices used in primary cost-effectiveness analyses will be based on estimates of prices net of rebates in the US market, instead of wholesale acquisition costs (WACs).

• ICER updated its calculations for the potential budget impact threshold for new drugs. For 2017-2018, that figure is a net of $915 million annually, calculated over a 5-year period.

Dr Dunn and Mr Smith agreed that key changes and updates is a step in the right direction. “[The] most impactful change is the use of net cost rather than WAC—net cost is more appropriate (but net cost will not be fully transparent and vary by payer),” said Dr Dunn.

“Yes, especially their willingness to listen to manufacturer’s representatives, all of whom are highly trained HECON [Health Economic] people, most with plan experience,” said Mr Smith. “ICER’s leadership realized if their ‘customers’ within payer groups don’t understand what they are saying, it very unlikely they will accept their recommendations.”

Payer Engagement Is Key

Stakeholders told First Report Managed Care that payer engagement is critical to ensure ICER reports are useful in informing health care benefit design.

“Payers set their benefits. Payers, providers, and ICER need to collaborate on use and acceptance. Then payers need to build and enforce benefits that support the findings,” explained Dr Dunn.

Mr DeKoven noted, “Payers need to be involved in the design and methodology of the reports, so they can use them to inform health care benefit design. If they are not engaged and will not use the reports, their usefulness decreases.”