Answers Beyond Bankruptcy to SNFs’ Current Economic Challenges

Genesis HealthCare is the nation’s largest provider of skilled nursing facility (SNF) services,1 currently operating around 500 SNFs and assisted living communities (ALCs) in 34 states across the United States. This is done through Genesis’ approximately 80,000 employees who also supply rehabilitation therapy to approximately 1700 health care facilities in 45 states and the District of Columbia.2 However, Genesis HealthCare recently made several moves in an attempt to avoid bankruptcy. For all SNF stakeholders and long-term care (LTC) providers aiming for success in this field, it may be helpful to try to understand and learn from Genesis HealthCare’s history. As the saying goes, “Those who fail to learn from the mistakes of their predecessors are destined to repeat them.”

It all began in 1985 when Genesis Health Ventures Inc was founded and started acquiring SNFs. Between 1985 and 1998, they had tremendous growth through the acquisition of more SNFs and services—revenue went from $32 million to $2.4 billion. It was in 1999 that Genesis Health Ventures first sought Chapter 11 protection as a result of sizable federal government cuts to Medicare. Several years later, Genesis was able to reorganize and reemerge from bankruptcy. In 2007, private equity investors Formation Capital and JER Partners assumed ownership of Genesis HealthCare, taking the company private. Four years later, they divided Genesis into 2 entities: one focused on real estate acquisition and the second responsible for operations.

So what can be learned from Genesis’s history? An important area to focus on is the cause of their first bankruptcy almost 20 years ago. That event was caused by a significant decrease in Medicare reimbursement for LTC, which provides some insight into the contributing causes of SNF’s financial challenges today.

Why SNFs Are Struggling Now

If one looks back 20 years ago, the cuts in reimbursement were due to a shift from cost-based reimbursement to capitated payment for subacute SNF services. The Balanced Budget Act of 1997 mandated the implementation of a per diem prospective payment system (PPS) for SNFs covering all costs (routine, ancillary, and capital) related to the services furnished to beneficiaries under Part A of the Medicare program.3 Today, a similar shift is occurring to value-based reimbursement. Genesis has attempted to take advantage of this shift through active participation in several programs, such as through accountable care organizations or the Medicare Shared Savings Program (MSSP). For Genesis, while the MSSP did not result in them receiving funds through gain share, they consider participation in the MSSP program and the Bundled Payments for Care Improvement Model 3 program vital to their long-term success. They have stated that the experience and know-how gained, along with access to vital information about the total episodic cost of their patients, including the cost postdischarge from centers, will continue to give them a leg up in the further development of our value-based operating model.4 Of course, these savings primarily will come from cuts in their inpatient volume through shorter lengths of stay and admissions, but it is an attempt to mitigate some of these losses.

According to Genesis, the cause of their present woes is again due to health care financial reform efforts aimed at keeping older adults out of SNFs as well as reducing the amount of time they spend in facilities. Both have caused reductions in skilled patient admissions and shortened lengths of stay, but facility operating expenses have increased through escalating wage inflation, professional liability losses, and increased cost of capital through escalating lease payments.4

Article continue on page 2

Another aspect to consider is that, within the more profitable skilled mix (subacute Medicare Part A) category of patients, migration toward managed Medicare products continues to occur. Managed Medicare admissions inherently yield about a 20% reduction in length of stay and about a 10% to 15% lower rate per-patient day compared with traditional Medicare.5 These topline pressures are further exacerbated by the fact that government-sponsored reimbursement rate growth is not keeping pace with inflation and cost, particularly nursing labor costs amid a strengthening labor market. This decrease in Medicare reimbursement to SNFs is made worse because of chronic and significant underfunding by the state medical assistance programs through Medicaid. And this lack of funding for Medicaid is expected to get even worse as states experience sustained economic burden while the federal government grants states the ability to decrease their Medicaid obligations.6

Future Opportunities and Challenges

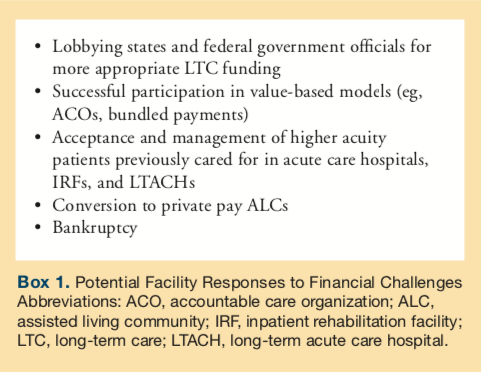

In the future, SNF providers are highly likely to see continued operating cost increases and significant Medicare rates and utilization decreases. These negative developments can only be countered by heavy lobbying of both state and federal government officials for more appropriate LTC reimbursement (Box 1). In addition, there is an opportunity for SNFs to increase admissions to their facilities through shifting patients from acute care hospitals, inpatient rehabilitation facilities, and long-term acute care hospitals. This will require SNFs increasing their level of care provided as well as being equipped to accept direct admissions from the community primarily through a dedicated medical staff. Much of these opportunities can be lead through this dedicated medical staff.

Another likely future market shift is the conversion of SNFs to ALCs. Already, in response to these government funding challenges, several SNFs have converted to community-based residential facilities, a type of assisted living.7 The payer in these facilities are private payers, which allows facilities to adjust to market conditions such as increases in operating costs. Of course, this is not an option for SNFs receiving government reimbursement as those prices are non-negotiable but rather set by states and the federal government. Besides the frustration of these prices being set by the government, these levels are not higher for higher quality facilities, although this will likely change over time, providing some relief for high quality facilities while additional pressure persists for lower quality facilities.

Ultimately, SNFs will need to be of high quality with expanded abilities and scope of services so they can take full advantage of value-based reimbursement as well as more acute direct admissions. Without these adjustments ahead of market changes, many facilities will become part of history repeating itself.

References

1. Top 50 largest nursing facility companies. Provider. 2016;48-51. https://www.providermagazine.com/reports/Documents/2016/0616_Top50.pdf. Accessed January 16, 2018.

2. Genesis Healthcare Inc. A leading provider of post-acute services. Genesis Healthcare

website. https://www.genesishcc.com/Portals/0/pdfs/Investors/Genesis%20Health

Care%20_%20%20Presentation%20May%202017.pdf. Published May 2017. Accessed January 18, 2018.

3. Centers for Medicare & Medicaid Services (CMS). Skilled nursing facility PPS. CMS website. https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SNFPPS/index.html. Updated August 23, 2017. Accessed January 18, 2018.

4. Genesis Healthcare’s (GEN) CEO George Hager on Q3 2017 Results - Earnings Call [transcript]. Seeking Alpha. November 9, 2017. https://seekingalpha.com/article/4123690-genesis-healthcares-gen-ceo-george-hager-q3-2017-results-earnings-call-transcript. Accessed January 16, 2018.

5. Medicare Payment Advisory Commission (MedPAC). Chapter 8, Skilled nursing facility services. In: Report to the Congress: Medicare Payment Policy. https://www.medpac.gov/docs/default-source/reports/chapter-8-skilled-nursing-facility-services-march-2015-report-.pdf?sfvrsn=0. Published March 2015. Accessed January 18, 2018.

6. Garfield R, Rudowitz R. State-by-state estimates for reductions in federal Medicaid funding under repeal of the ACA Medicaid expansion. Kaiser Family Foundation website. https://www.kff.org/medicaid/issue-brief/state-by-state-estimates-of-reductions

-in-federal-medicaid-funding-under-repeal-of-the-aca-medicaid-expansion/. Published July 19, 2017. Accessed January 18, 2018.

7. Mullaney T. Top senior housing trends in 2018. Senior Housing News. https://seniorhousingnews.com/2018/01/08/top-senior-housing-trends-2018/. Published January 8, 2018. Accessed January 18, 2018.