Comparative Review of Anticoagulant Coverage Across 3 Major Health Plans

When thinking of anticoagulants as a drug class, their treatment and usage across therapeutic areas is vast and growing. Anticoagulants can treat patients across these therapeutic areas, from blood clotting disorders to thromboembolic disorders to cardiovascular diseases and acute myocardial infarction, depending on the insurance plan and patient profile. Conditions across these therapeutic areas vary; however, the American Heart Association reports that anticoagulant use rose from 56.3% to 64.7% between 2011 and 2020.1 This increase was consistent across age, sex, race, and ethnicity, though it varied among different health systems.1 But what factors determine treatment approaches, and how do formularies decide on coverage for a drug class used across diverse patient populations?

Consider hemophilia, a condition that disrupts the body’s ability to properly coagulate blood. Normally, blood coagulation involves a series of proteolytic activation reactions in which clotting factors sequentially amplify each other's activities, ultimately leading to a burst of thrombin.2 To manage this, providers may prescribe anticoagulants like tissue factor pathway inhibitors (TFPIs), a protein that blocks the initial stages of the procoagulant response.2

What about patients with deep vein thrombosis or pulmonary embolisms? Providers may prescribe an oral anticoagulant such as factor Xa inhibitors.3

While treatment and uses sound complex when it comes to this drug class, numerous payers include different types of anticoagulants on their formularies. First Report Managed Care analyzed formularies across 3 insurance plans to understand coverage in this competitive treatment landscape to understand how easy it is for patients with a need to access anticoagulant therapy, and what costs are associated for these patient populations to receive this treatment.

Data was extracted across 3-Tier and 5-Tier drug plans from notable health insurance companies: Blue Cross Blue Shield (BCBS) 5-Tier Standard Formulary (2025), Cigna’s 5-Tier Formulary (2024), and United Healthcare’s Advantage 3-Tier Plan (2024). Each table represents categories of antiocoagulants. Of note, each insurance plan defines Tier coverage according to organizational standards. Definitions are identified in each table for clarity, and branded drugs are shown in uppercase and generic drugs are lowercase for clarity.

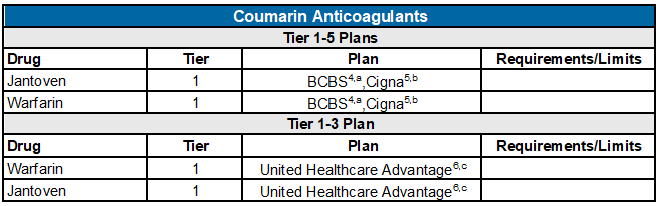

Table 1. Coumarin Anticoagulants Formulary Coverage

aLevel or Tier 1: Preferred, low-cost generic drugs; Level or Tier 2: Preferred brand drugs; Level or Tier 3: non-preferred drugs and all compounded medications; Level or Tier 4: preferred specialty drugs; Level or Tier 5: non-preferred specialty drugs.4

bLevel or Tier 1: Generic drugs (low-cost); Level or Tier 2: preferred brand drugs (preferred), and some high-cost generic drugs; Level or Tier 3: non-preferred brand name drugs; Level or Tier 4: specialty drugs (preferred); Level or Tier 5: highest-cost drugs.5

cLevel or Tier 1: lower-cost; Level or Tier 2: mid-range cost; Level or Tier 3: highest cost.6

Abbreviation: BCBS, Blue Cross Blue Shield.

Upon reviewing 3-Tier through 5-Tier formulary plans, one thing is clear: the generics warfarin and jantoven are the preferred, low-cost options. Across all formularies reviewed, coumarin anticoagulant coverage remains consistent. Both generics appear accessible and cost-effective for patients covered on these plans.4-6

Table 2. Direct Factor XA Inhibitor Formulary Coverage

aLevel or Tier 1: Preferred, low-cost generic drugs; Level or Tier 2: Preferred brand drugs; Level or Tier 3: non-preferred drugs and all compounded medications; Level or Tier 4: preferred specialty drugs; Level or Tier 5: non-preferred specialty drugs.4

bLevel or Tier 1: Generic drugs (low-cost); Level or Tier 2: preferred brand drugs (preferred), and some high-cost generic drugs; Level or Tier 3: non-preferred brand name drugs; Level or Tier 4: specialty drugs (preferred); Level or Tier 5: highest-cost drugs.5

cLevel or Tier 1: lower-cost; Level or Tier 2: mid-range cost; Level or Tier 3: highest cost.6

Abbreviations: BCBS, Blue Cross Blue Shield; NDS, non-extended days' supply; QL, quantity limit.

A review of 3-Tier through 5-Tier formulary plans reveals inconsistent coverage for direct factor Xa inhibitors across different plans. While brand names like ELIQUIS and XARELTO are designated as Tier 2 for the BCBS 2025 formulary coverage plan and the 2024 United Healthcare formulary coverage plan, both are designated as Tier 3 drugs in the 2024 Cigna formulary coverage plan. Despite the definitions for Tier 2 drugs under BCBS and United Healthcare formularies (eg, preferred brand drugs/mid-range cost drugs), Cigna designated these drugs as Tier 3, non-preferred brand name drugs. For patients with pulmonary embolism or stroke, drug coverage for direct factor XA inhibitors for treatment appear to be more cost-effective under BCBS and United Healthcare plans.

Table 3. Blood Thinner Formulary Coverage

aLevel or Tier 1: Preferred, low-cost generic drugs; Level or Tier 2: Preferred brand drugs; Level or Tier 3: non-preferred drugs and all compounded medications; Level or Tier 4: preferred specialty drugs; Level or Tier 5: non-preferred specialty drugs.4

bLevel or Tier 1: Generic drugs (low-cost); Level or Tier 2: preferred brand drugs (preferred), and some high-cost generic drugs; Level or Tier 3: non-preferred brand name drugs; Level or Tier 4: specialty drugs (preferred); Level or Tier 5: highest-cost drugs.5

cLevel or Tier 1: lower-cost; Level or Tier 2: mid-range cost; Level or Tier 3: highest cost.6

Abbreviations: BCBS, Blue Cross Blue Shield; E, excluded; NDS, non-extended days' supply; QL, quantity limit.

According to the data analyzed, remaining blood thinners appear to be the most common drug offered across the formularies reviewed; however, Tier level across all 3 plans vary regarding pricing. Brand names ARIXTRA and LOVENOX SOSY were designated Tier 2 drug coverage for BCBS, while no coverage is offered for these drugs on Cigna and United Healthcare plans. Enoxaparin sodium soln is covered across all 3 plans, but designated with different Tier levels (eg, Tier 1 for BCBS, Tier 4 for Cigna, Tier 2 for United Healthcare [including a quantity limit]). When trying to formulate a rationale for the variance in coverage, First Report Managed Care reviewed efficacy data from a 2018 study regarding the safety and efficacy of enoxaparin in a randomized study with percutaneous coronary intervention for patients with ST-elevation myocardial infarction.7 According to study authors, the rate of death and myocardial infarction (MI) was significantly lower than those who received unfractionated heparin.7 Despite the success of enoxaparin use, authors did note that the clinical application of the treatment has been “controversial.”7 It should be noted that the follow-up interval for this meta-analysis of 5585 patients was 30- or 90-days. This may be appropriate for one of the end-points (death) but may be relatively short for the other chosen endpoints of MI or major bleeding (for which there was no difference between therapies). It would be interesting to learn what the stance is for BCBS, Cigna, and United Healthcare is given the inconsistent coverage and pricing of this drug on their formularies.

Table 4. Thrombin Inhibitor Formulary Coverage

aLevel or Tier 1: Preferred, low-cost generic drugs; Level or Tier 2: Preferred brand drugs; Level or Tier 3: non-preferred drugs and all compounded medications; Level or Tier 4: preferred specialty drugs; Level or Tier 5: non-preferred specialty drugs.4

bLevel or Tier 1: Generic drugs (low-cost); Level or Tier 2: preferred brand drugs (preferred), and some high-cost generic drugs; Level or Tier 3: non-preferred brand name drugs; Level or Tier 4: specialty drugs (preferred); Level or Tier 5: highest-cost drugs.5

cLevel or Tier 1: lower-cost; Level or Tier 2: mid-range cost; Level or Tier 3: highest cost.6

Abbreviations: BCBS, Blue Cross Blue Shield; ST, step therapy; QL, quantity limit.

For anticoagulants like thrombin inhibitors, coverage begins to grow limited and vary across plans. Oddly enough, BCBS deems the generic dabigatran as a Tier 1, low-cost option. However, Cigna designated it as a Tier 4 specialty drug. Comparing both to United Healthcare Advantage, this formulary designated it as a Tier 2 mid-range option.

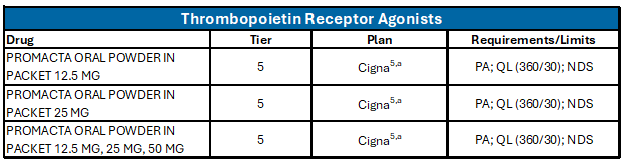

Table 5. Thrombopoietin Receptor Agonist Formulary Coverage

aLevel or Tier 1: Generic drugs (low-cost); Level or Tier 2: preferred brand drugs (preferred), and some high-cost generic drugs; Level or Tier 3: non-preferred brand name drugs; Level or Tier 4: specialty drugs (preferred); Level or Tier 5: highest-cost drugs.5

Abbreviations: PA, prior authorization; QL, quantity limit; NDS, non-extended days' supply.

Most notably, Cigna appears to be the only formulary investigated by First Report Managed Care among the three plans that covers thrombopoietin receptor agonist at all, designating brand name PROMACTA a Tier 5.

Conclusion

Anticoagulants serve diverse purposes across therapeutic areas, but a key consideration is how health plans like BCBS, Cigna, and United Healthcare determine coverage for patients needing these medications. While this is not an exhaustive overview of all insurance plan formularies, First Report Managed Care’s analysis of these 3 plans offers insights into what patients should consider when selecting a formulary, and what payers may want to consider when determining drug coverage when reviewing competing formularies.

Note from FRMC Editorial Board Member

This analysis vividly demonstrates that coverage benefits and tier placement for oral anticoagulant therapies varies significantly. The observations in this article, while focusing on only three health plans, are illustrative and commonplace across the industry. Tier placement decisions are often based on readily identifiable parameters such as generic versus brand availability. Cost considerations are not insignificant however, both for patients as well as payers. The costs of these medications may vary as much as 35-fold. Cost considerations, not only for the actual medication but for testing and the incidence and treatment of adverse events, morbidity and mortality (e.g. overdose with significant bleeding, reversal therapy, potential hospitalization) must also be entertained. These cost factors are typically included in decisions to subject these medications to step-therapy. Additional considerations are less transparent, such as preferred versus non-preferred status, rebates, and tier-placement negotiations for unrelated therapies produced by the manufacturer and placement of these medications against competitive therapies. The latter considerations are not under the control of the payer but rather the PBMs, although for vertically-integrated organizations such as United Healthcare/Optum mentioned in this article, there may be greater discretion. Finally, for government-sponsored payers such as Medicare Advantage and managed Medicaid, there are additional formulary requirements to include specific medications, formulations, and choice of alternatives. Medications obtained from specialty pharmacies may be subject to additional restrictions to protect against Fraud, Waste, and Abuse.

References

- Navar M, Kolkailah A, Overton R, et al. Trends in oral anticoagulant use among 436 864 patients with atrial fibrillation in community practice, 2011 to 2020. J Am Heart Ass. 2024;11(22). doi.10.1161/JAHA.122.026723

- Mast AE. Tissue factor pathway inhibitor: multiple anticoagulant activities for a single protein. Arterioscler Thromb Vasc Biol. 2016;36(1):9-14. doi:10.1161/ATVBAHA.115.305996

- FEP Blue Standard Formulary. Blue Cross Blue Shield. Effective January 1, 2025. Accessed November 14, 2024. https://www.caremark.com/portal/asset/z6500_drug_list_OE.pdf

- Factor Xa Inhibitor. 2023. Accessed November 14, 2024. https://my.clevelandclinic.org/health/treatments/24745-factor-xa-inhibitors

- 2024 Cigna Healthcare Comprehensive Drug List (Formulary). Cigna. 2024. Accessed November 14, 2024. https://www.cigna.com/static/www-cigna-com/docs/medicare/plans-services/2024/formulary-extra.pdf

- Your 2024 Prescription Drug List: Advantage 3-Tier. United Healthcare. 2024. Accessed November 14, 2024. https://www.uhc.com/content/dam/uhcdotcom/en/Pharmacy/PDFs/pharmacy-pdl-3t-adv-may-2024.pdf