Will New Guidance Improve Outcomes in Patients With Chronic Conditions?

The IRS—with input from HHS—expands list of preventive care options for HSA participants with high deductible health plans. Our experts offer insights, predict the level of adoption, and address potential downsides.

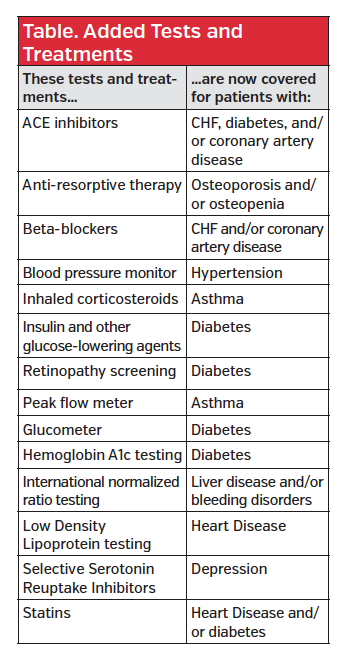

On July 17, 2019, the Internal Revenue Service (IRS) added care for a number of chronic conditions to the list of preventive care benefits that are allowable under high deductible health plans (HDHPs). Per the IRS guidance, individuals with HDHPs “may establish and deduct contributions to a health savings account (HSA) as long as they have no disqualifying health coverage.” The guidance—prepared with input from the Department of Health and Human Services—adds 14 tests and treatments for patients with one or more of 12 chronic conditions (Table). The prescribed services must:

- Be low-cost;

- Have high cost efficiency (ie, a large expected impact); and

- Be expected to prevent exacerbation of a patient’s chronic condition or the development of a secondary condition that would lead to higher costs.

The guidance took effect immediately, which means it could be a part of plans offered for 2020. We asked our managed care experts to analyze the new guidance, particularly as it fits within the value-based insurance design framework, predict its level of adoption, address potential negatives, and more. Our panelists included:

- Larry Hsu, MD, medical director, Hawaii Medical Service Association, Honolulu, HI

- David Marcus, director of employee benefits, National Railway Labor Conference, Washington, DC

- Arthur Shinn, PharmD, president, Managed Pharmacy Consultants, Lake Worth, FL

- F. Randy Vogenberg, PhD, RPh, principal, Institute for Integrated Healthcare, Greenville, SC

Do you foresee the new guidance making a meaningful dent in overall health spending?

Mr Marcus: Payers who offer HDHPs will see an uptick in expenditures because these services can be covered prior to satisfaction of the statutory minimum deductible. However, in general, I doubt that patients have been foregoing care for chronic conditions merely because they had not yet satisfied the deductible. It happens in some instances, but I do not think it is prevalent.

Dr Vogenberg: Any change will take time to have an impact that is meaningful. The questions are, one, how fast change occurs and, two, can the new trend of use be sustained into 2021?

Dr Hsu: With these 14 additions, the overall costs will not be that high. For certain drugs—including ACE inhibitors, antiresorptive therapy, SSRIs [selective serotonin reuptake inhibitors], and statins, the available treatments are mostly generic, and thus low cost. Also, even with more testing like retinopathy screening, or HBA1c testing, this is the right thing to do to make early diagnoses and hopefully save cost down the line.

Dr Shinn: I agree with everything that’s been said. This initiative can help, but on a limited basis. I don’t see it making a huge difference.

This is part of value-based insurance design. Do you see more opportunity in this area with other similar concepts?

Dr Hsu: I think so. Beyond the talk about value-based formularies, which are still evolving, value-based insurance designs are critically needed. This is a good start. From here, health plans need to develop and promote insurance plans that have benefits that are of high value and good return on costs. There should be expansion of preventive benefits, gym membership to promote exercise and fitness, nutritional counseling, and obesity programs that over time lead to lower costs. That is how you ultimately lower overall health spending.

Mr Marcus: I agree. There is value in encouraging patients to seek preventive services, and eliminating barriers for chronic illness maintenance medications is a helpful development. Any plan design that incentivizes services that are high-value and disincentivizes low-value services is an improvement over mainstream benefit plan design. However, there does not appear to be widespread consensus around what is and isn’t considered high-value. It seems elusive at this point.

Dr Vogenberg: The IRS guidance could open the door for a value-based insurance design strategy to evolve that includes a focus on chronic care. Still, keep in mind that this is new guidance, not a permanent regulation or law change. I think the real opportunity is to let the market work to try more impactful, innovative chronic care management that incorporates principles of value-based care.

[For additional perspective on value-based insurance design, see Sidebar]

Critics say a program like this has the potential to encourage more to enroll in HDHPs, shifting more costs to consumers. Do you agree?

Mr Marcus: I do not see that happening, since traditional plans cover these services after satisfaction of smaller deductibles. I have to say, though, high-cost plans that place insignificant financial responsibility on consumers do nothing but encourage overutilization of unnecessary care. In the absence of a true value-based plan design, HDHPs at least require consumers to think about what they value.

Dr Vogenberg: I think that’s true, but it can go further in the other direction. HDHPs that require significant up-front costs may cause consumers to forgo care, even if they have HSA dollars to spend. This could dampen or minimize the intended goal of driving value-based change that improves on current market offerings.

Dr Hsu: I think the new guidance might encourage a shift. But most people who have medical issues and want peace of mind won’t shift to HDHPs just because of this. The high-deductible plans are mostly pursued by the relatively young and healthy who have no major or only minor health issues.

Critics also say that implementing this guidance potentially contributes to health disparities, since only a certain segment of the population can afford to maintain HSAs. Is that valid?

Dr Shinn: I have clients who make these types of plans and accounts available, but don’t see too many people taking advantage of them mainly because people rely on their total salary and can’t put anything aside.

Dr Vogenberg: Lower income/wage earners may not fit well with this initiative compared to other strategies in benefit plans that reduce out-of-pocket spending.

Dr Hsu: This may be true to some degree, since the experience so far is that the young and healthy open and maintain HSAs and have HDHPs. But the good news is this is not a sizeable part of the insurance market to begin with. As already noted, these changes are not that significant to increase the flow to these plans.

Mr Marcus: The segment of the population that cannot afford HSAs are simply not going to enroll in HDHPs. Traditional health plans are generally more expensive, but they do cover services following satisfaction of a smaller deductible.

What, if anything, can be done for those with chronic conditions who cannot afford HSAs?

Mr Marcus: Traditional coverage is a better fit. For employer-sponsored plans, the employer could pay in seed money to help or establish health reimbursement arrangements that do not have the same restrictions as HSAs.

Dr Hsu: Those who can’t afford to maintain an HSA ideally should be enrolled in a value-based insurance plan that promotes preventive care, vs paying just when the patient gets sick.

Dr Vogenberg: I think more research is needed to determine the best components of such a program. This can be accomplished using employer profiles that help uncover optimal complementary strategies.

Even though the guidance is voluntary, payers have been asking for it. Given that, do you see quick adoption?

Mr Marcus: I think so. Though payers face an initial uptick in plan costs due to the pre-deductible coverage, in the long-run, the hope is that this will improve health outcomes and in turn reduce costs for insurers.

Dr Hsu: Adoption should be moderately swift since the preventive guidelines appear to be evidence-based and thus are presumably cost-effective.

Dr Vogenberg: Stakeholders that offer HDHPs and HSAs might be quick to adopt because it fits with those offerings. Overall, adoption is likely to be dependent on the market psychology and willingness of an employer plan sponsor to make the change for 2020 or wait.

Dr Shinn: Value-based initiatives that address problems early for patients with chronic conditions are excellent and much needed. But, as I already stated, I don’t see this particular initiative gaining much meaningful traction.

How should payers and other managed care stakeholders be preparing?

Dr Vogenberg: Each employer would have to fully evaluate options based on their current plan, business environment, and other factors.

Dr Hsu: They need to figure out, given their population, how many people will use these services. Then they need to develop the infrastructure to adequately manage the administration of these benefits.

Dr Vogenberg: The bottom line is, with the current volatility in the health care market, upcoming presidential election uncertainties, and the current voluntary nature of this coverage guidance, it’s difficult to know if this is attractive enough to make a sustainable difference in the marketplace. We could see a wait-and-see approach as payers decide to pursue other plan savings and consumer cost savings strategies.