Specialty Pharmacy Trends Report: Hepatitis C

Hepatitis C is a contagious disease of the liver caused by the hepatitis C virus (HCV) that ranges in severity from acute to chronic. Acute hepatitis C is a short-term illness occurring

within the first 6 months after exposure to HCV, while chronic hepatitis C is a long-term

illness, in which the HCV remains in a person’s body. According to the World Health Organization, approximately 150 million people are infected with chronic hepatitis C, and every year >350,000 people die from hepatitis C-related liver diseases. In 25% of liver cancer patients, the underlying cause is hepatitis C.

In some cases, hepatitis C will clear without treatment. The most common form of treatment, however, is a combination antiviral therapy with interferon and ribavirin. While most interferon treatments are administered in the form of a pill, weekly self-injections are now available.

__________________________________________________________________________________________________________________________________________

When asked if they are involved in reporting adherence and/or compliance on the use of hepatitis C

medications obtained through specialty pharmacy, 27.78% of the survey participants said they are involved “a great deal,” while 24.07% said “a moderate amount,” and 22.22% said “never” (Figure 1).

Most of the survey respondents (72.22%) said 0% to 25% of their specialty pharmaceuticals for the

treatment of hepatitis C require in-office administration of the drug (Figure 2).

A majority of the survey participants (75.93%) feel that campaigns for early detection of hepatitis C

have increased the number of patients being treated, while 14.81% said they were unsure, and 9.26% said they have not increased the number of patients being treated (Figure 3).

Most survey respondents (61.11%) said they have seen a decrease in the “warehousing” of hepatitis C

patients, 27.78% said they were unsure, and 11.11% said they have not seen a decrease (Figure 4).

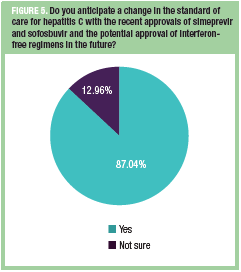

The majority of survey participants (87.04%) said “yes” when asked if they anticipated a change in the standard of care for hepatitis C with the recent approvals of simeprevir and sofosbuvir and the potential approval of interferon-free regimens in the future, while 12.96% said they were unsure (Figure 5).

Specialty pharmacy is a burgeoning field that continues to be of importance for managed care professionals. With the rates of chronic, high-cost conditions increasing, payers are eager to find ways to diffuse costs, while also providing patients with the best care possible. First Report Managed Care partnered with the National Association of Specialty Pharmacy to put together this Specialty Pharmacy Trends Report.

The information for this trends report was generated through a comprehensive survey developed via the collaborative efforts of an Advisory Panel of key thought leaders and the First Report Managed

Care editorial staff. This survey was then sent to a diverse pool of specialty pharmacy professionals. This is part 1 of a 3-part series we bring to you on the climate of specialty pharmacy as it relates to the managed markets. We hope that you find the information presented to be practical, informative, and compelling. We hope the survey results serve as a resource you can use in making future management decisions.

Survey Participant Demographics

Key thought leaders in the field of specialty pharmacy have provided the information collected in this Specialty Pharmacy Trends Report series. The following are the demographic responses, providing a snapshot of the survey participants and the organizations for which they are affiliated.

The Northeast is home to most of the survey participants (33.93%), while 28.57% of participants are in the Midwest, 10.71% in the Southeast, 10.71% in the Pacific, 10.7% in National regions, 3.57% in the Mountain region, and 1.79% said “not applicable.”

The majority of the survey respondents (60.71%) have a PharmD degree, while 39.29% have a BS in

Pharmacy, 17.86% have an MBA, 10.71% have an MS, and 5.36% have a PhD. A significant majority of survey participants (53.57%) have an RPh certification, while 17.86% have a BCPS, and 12.5% have a CSP.

When asked how long they have been in the specialty pharmacy field, 35.71% of survey participants said 0 to 5 years, while 28.57% said 11 to 20 years, and 26.79% said 6 to 10 years.

Mail-order specialty pharmacy is the primary facility of work for 23.21% of the survey participants. An additional 16.07% said their primary facility of work is an academic institution (not a university hospital), another 16.07% said a managed care organization, 14.29% said a retail specialty pharmacy,

and 10.71% said a consulting firm.

When asked what type of specialty pharmacy they are involved with, 26.79% of the survey respondents said independently owned (nonretail) and another 26.79% said pharmacy benefits manager. Another 16.07% of the survey respondents are involved with a health plan-owned specialty pharmacy and 14.29% are retail pharmacy owned.

Most of the survey respondents (39.29%) reported that they have 1% to 25% of patient interaction time on a monthly basis, while 28.57% said their role does not currently involve patient interaction.

When the survey participants were asked to select the top 5 therapeutic categories with which they are

most involved, and with the option to select up to 5 areas, the results were the following:

• Oncology (69.64%)

• Rheumatoid arthritis (67.86%)

• Hepatitis C (64.29%)

• Multiple sclerosis (50%)

• Diabetes (37.5%)

• Crohn’s disease (35.71%)

• Psoriasis/Psoriatic arthritis (35.71%)

• HIV/AIDS (25%)

• Hemophilia (23.21%)

• Immunoglobulins (12.5%)

• Cystic fibrosis (8.93%)

• Hereditary angioedema (5.36%)

• Gout (3.57%)

• Infertility (1.79%)