Is the Trump Blueprint to Lower Drug Prices Working?

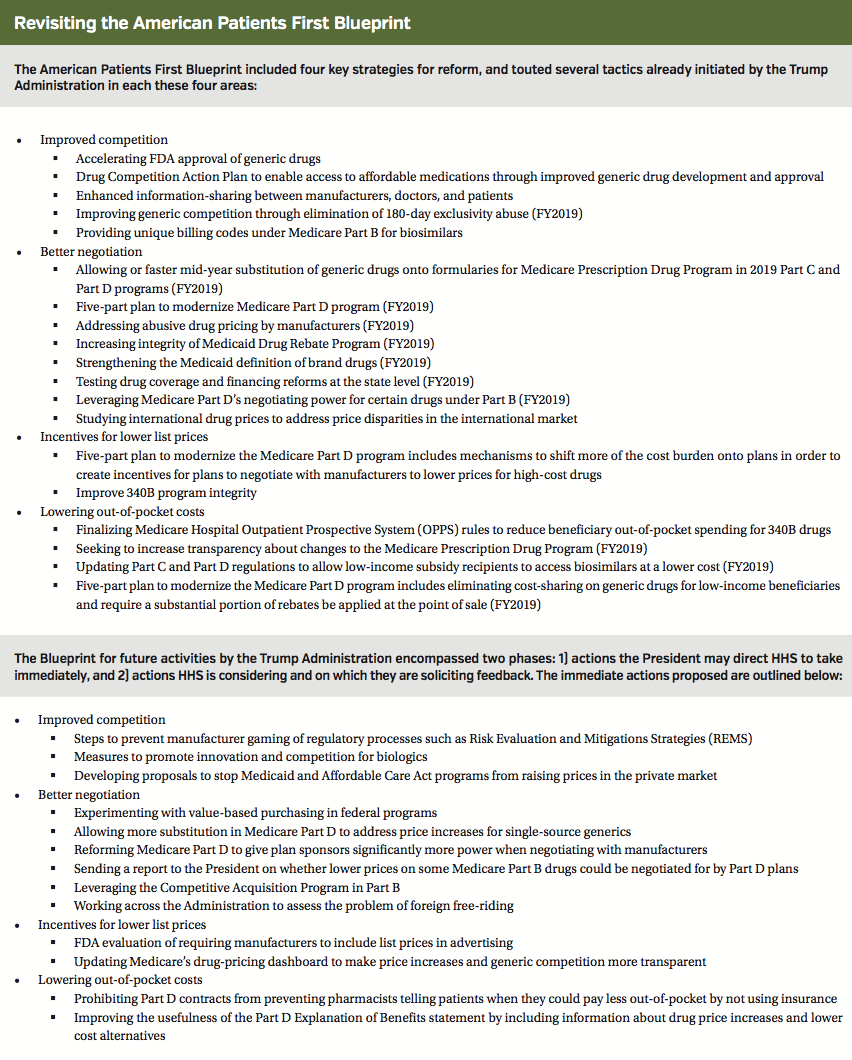

In May, the Trump Administration released a plan to tackle escalating drug prices in the United States. Titled “American Patients First: The Trump Administration Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs,” the Blueprint outlined a sweeping plan for bringing down drug prices and lowering out-of-pocket costs for American consumers (see Inset on page 38 for more details on the proposals outlined in the Blueprint).

In the June issue of First Report Managed Care, a panel of managed care experts parsed through this plan (“Inside President Trump’s Drug Pricing Policy”; First Report Managed Care. 2018;16(6):26-27). At the time, many felt that the plan was a rough framework with few specifics and was unlikely to have meaningful effects on drug pricing in the shortterm. Still, others suggested that it was likely that a more detailed approach was in development, which would have a greater chance of substantial effects in the longterm.

Now, the administration has released an update on its progress on implementing some of the reforms and outcomes described in the Blueprint. “The [blueprint] is working, drug prices are coming down, and American patients are going to see the savings in their pocketbook,” HHS Secretary Alex Azar proclaimed in the report, titled “Report on 100 Days of Action on the American Patient First Blueprint.”

Here, we take a look at some of the key proposals on which the 100-day report provides an update. We also reconvened our key thought leaders to address the accomplishments outlined in the report. They aimed to provide a realistic assessment of how the actions touted have affected the pharmaceutical market, as well as overall health care costs, to date, as well as the potential for further HHS action to make a dent going forward.

More Generic Drug Approvals

As the report states, “In July [2018], FDA approved more generic drugs than in any other single month in history.”

The Trump Administration had previously touted its efforts to speed up the approval of generic drugs, resulting in a record 1000 generic drug approvals in 2017. These include steps by the FDA to prioritize review of generic drug applications, improve efficiencies in the review and approval processes for generic drugs, and streamline the submission and review process for shared system Risk Evaluation and Mitigation Strategies (REMS).

Experts agreed that the July approval numbers are a good sign of a continuing trend. “This trend goes back four of five years, when the FDA made a concerted effort to unclog the generic pipeline,” said David Marcus, director of employee benefits at the National Railway Labor Conference in Washington, DC. “To the extent that this increases competition, we should see reduced prices. How long it takes depends on a variety of factors, including the pricing arrangement between the payer and the pharmacy benefit manager.”

The effect will take time to work its way through the system, offered Marissa Schlaifer, RPh, principal at Schlaifer & Associates in Washington, DC. “While the first generic product to enter the market generally only lowers payer impact slightly, pricing decreases significantly when other generics [become available] after the six-month exclusivity period. Payers generally benefit when the second, third, and fourth products create a more competitive marketplace.”

Melissa Andel, vice president of health policy at Applied Policy in Washington, DC, put it this way: “To the extent that [generic] applications help [flood the market with] those later competitors, that should help lower prices.”

Some patients could see relief even sooner, said Ms Schlaifer. Specifically, “copays may decrease when the first [generic] product is approved under a flat rate copay system.”

Charles Karnack, PharmD, BCNSP, assistant professor of clinical pharmacy at Duquesne University in Pittsburgh, said he is skeptical. Generic approvals should provide some relief, he noted. However, “due to a continued lack of transparency, payers and patients will not see major changes in their costs in the next year.

F. Randy Vogenberg, PhD, RPh, principal of the Institute for Integrated Healthcare in Greenville, SC, said he finds the trend toward increased generic approvals encouraging, but patients are “not necessarily saving significantly more money. Time will tell.”

Norm Smith, a principle payer market research consultant in Philadelphia, wonders if the generic drug pipeline can keep churning out products at the current rate. “How many real opportunities like this exist every year? There may not be many, and the low hanging fruit will be picked very quickly.”

Plans now have generic dispensing ratios hovering in the upper 80% and lower 90% range, added Gary Owens, MD, president of Gary Owens Associates in Ocean View, DE. “There is not much more that can be squeezed out of generic savings.” Furthermore, the expensive oncology and specialty drugs approved over the past few years will not see generic competition anytime soon.

Improved Negotiating Power for Medicare Advantage Plans

According to the 100-day report, the CMS “has given Medicare Advantage new tools to negotiate lower prices for expensive Part B drugs.”

This refers to action taken in August 2018, when CMS announced it was giving Medicare Advantage plans the option of applying step therapy for physician-administered and other Part B drugs. Medicare Advantage plans that also offer a Part D benefit can be cross-managed across Part B and Part D. Step therapy can only be applied to new prescriptions for patients who are not actively receiving a given medication.

Additional steps are planned for fiscal year 2019 and include establishing an inflation limit for reimbursement of Part B drugs; reducing Wholesale Acquisition Cost (WAC)-Based Payment when Average Sale Price (ASP) is not available; and improving manufacturers’ reporting of ASPs to set accurate payment rates. HHS said that the savings will go to those who opt for Medicare Advantage plans that require step therapy.

So, are the shackles starting to come off in terms of giving Medicare increased negotiating authority?

“CMS has been pretty transparent that their goal is to give Medicare Advantage and Part D plans as many tools that are available to their commercial book of business to their Medicare book of business,” noted Ms Andel. “They seem to be working to try to find ways to give the plans more flexibility.”

“It’s a significant positive move,” offered Ms Schlaifer. “While it is just one tool, it is the first step in applying the negotiation practices used for years in Medicare Part D to another part of the benefit.”

Mr Smith said that greater negotiating ability might come at a cost to providers and patients. “Controlling physicians’ ability to select drugs cuts into their income and freedom to use the product of their choice. Patients may push back as well.”

Drs Karnack and Vogenberg do not believe there will be significant impact from this move, at least anytime soon. “It’s important to start somewhere, [but] I doubt if many patients will see actual relief,” said Dr Karnack. Added Dr Vogenberg: “I am not convinced this will help lower patient costs or provide an advantage for Medicare as a purchaser.”

Dr Owens said the impact remains to be seen but speculated that since “plans will have the ability to have preferred agents on the medical benefit side in Medicare, that may allow some ability to negotiate price for a preferred agent where there are multiple choices in the category.”

The report claims that savings from the newly granted negotiating leverage could be passed on to seniors “as soon as next year.” Our experts say any impact in 2019 will be small—the real effects will be felt after that.

“It is possible” that patients will benefit next year, “but unlikely,” said Dr Vogenberg. Patent issues and supply chain shortages remain an important impediment to achieving the ability to deliver cost savings down to the patient level.”

Offered Ms Andel: “To the extent that negotiated prices are impacted by changes in list price, then beneficiaries could get some relief in 2019 through coinsurance and their progression through the donut hole, which should happen slightly faster due to the larger manufacturer rebates.”

Still, 2020 is the best bet for patients to feel real change. “Because the announcement came relatively close to the start of open enrollment, I’m not sure how quickly plans will be able to operationalize something meaningful for 2019,” explained Ms Andel. Moreover, “step therapy is limited to new patient starts and has interesting rules for how plans may and may not share the savings with beneficiaries, at least until rulemaking on the issue can be finalized.”

Ms Schlaifer agreed. “There are many unanswered questions about how the program will operate. Medicare Advantage plans need clarification on the system of sharing savings with beneficiaries.”

Impact of Policies on Drug Price Increases

The report states, “Within these first 100 days, 15 drug companies have reduced list prices, rolled back planned price increases, or committed to price freezes for the rest of 2018.” Specifically, two lowered list prices or rolled back increases, four canceled planned increases, and 13 committed to freezes for rest of year.

Dr Owens believes the 100-day report appears to be telling the story selectively. For instance, according to Wells Fargo’s August 2018 Drug Pricing Report, while there were 80 total price decreases in July and August, there were also 170 total price hikes during that time. Moreover, the median price increase in August was nearly 10%. “That does not sound like meaningful price moderation to me.”

Another report by the Associated Press in September 2018 showed that there were far more price hikes than cuts over the first 7 months of the year (96 price hikes for every price cut). The number of increases slowed somewhat and were not quite as steep as in past years, the AP found.

Mr Smith said he sees a shell game. “The ‘price freezes’ will shuffle product [price] increases into later in the year” in order to make up “shortfalls caused by the price hike delays.”

The Trump Administration is touting the fact that there were 60% fewer price increases between mid-May and mid-August 2018, vs the same period last year. “Which drug prices are being lowered?” asked Dr Karnack. “Do they treat specific common disease states?” Added Dr Owens: “It is easy to lower the price on drugs that are infrequently used and offset those decreases with small price increases on heavily utilized and expensive drugs. It going to take a lot more analysis and time to actually know if prices are changing substantially for the better.”

Whether price reductions—or increases for that matter—are real or not is a question best answered by payers and patients, said Ms Andel. She thinks it’s too soon to know for sure. “How much does [adjustment of the] list price of these products impact the net cost? For payers, are they coupled with higher rebates to offset any increase? Most patients think about drug costs as their out-of-pocket expense at the pharmacy counter. If their deductible increases next year, or their cost-sharing increases from $50 to $60, will the patient feel as if they are benefiting from the policies?”

Dr Karnack has worked in the trenches with a firsthand view of patients. “I see how drug prices directly affect individuals.” He said that he believes it’s too soon to tell if impactful steps have been taken, adding that his gauge is simple: “Any lowering of drug prices for routine maintenance drugs—such as insulin—is meaningful.” Thus, he’s looking for a reduction in noncompliance among patients with chronic conditions who are tempted to skip doses or take half doses in order to stretch their medications.

“Policies designed to target prescription drugs based on a price increase of a certain percentage can be misguided,” explained Ms Andel. She pointed to the Medicare Part D Drug Spend Dashboard as evidence. Between 2015 and 2016, the price of epinephrine increased 616%, but Medicare spent just $125,000 on it for 160 beneficiaries. Meanwhile, during the same period the price of the hepatitis C drug ledipasvir/sofosbuvir (Harvoni) increased just 1%, but Medicare spent nearly $4.4 billion on 53,000 beneficiaries.

It is clear to see that a 5% price reduction of one drug is much more impactful than the other—$220 million vs ~$60,000. Plus, “it also shows how large the Medicare spending universe is and helps to keep savings in perspective,” Ms Andel said. “Something that would save $100 million might sound great in isolation, but that is essentially a rounding error for CMS.”

Mr Smith said he believes that real change will occur when net prices are lowered on the meds that have a substantial impact on pharma’s bottom line—namely, oncology products, newer oral anticoagulants, and orphan drugs for rare diseases. “Increasing the list price on a contracted product has minimal impact on the net price bottom line,” he cautioned.

Too Soon to Tell?

It is important to note that most of the proposals outlined in the American Patients First Blueprint are slated for 2019 and after.

“One hundred days is simply not enough time for any concrete plan, let alone a vague blueprint, to have a meaningful effect on [pricing],” offered Mr Marcus. He noted that the statistics cited in the report “are consistent with the prevailing trend in place before the Trump blueprint was released.” Drug companies are likely responding to the competitive market or pressure from trade organizations, he said.

Dr Owens concurred. “It is not clear that there is any correlation between manufacturer price changes and what the administration has done to date.”

While HHS acknowledges that many of their proposals have not yet been implemented, they argue that their plans have put manufacturers on notice. “These shifts in pricing are just the beginning of a sea change in drug markets, as manufacturers respond to new incentives and comprehend more dramatic changes to come,” the 100-day Report reads.

Dr Karnack said he is encouraged that the Trump Administration has used shaming tactics to get pharma companies to roll back some increases, and he is hopefulthat it will make a difference.

Dr Vogenberg agreed. “Timing is always a big part of political credit-taking, but there has been some value in putting pressure” on manufacturers. He said we will not start to know the impact until January but, in his view, real change requires more than simple list price adjustments.

“Brand drug price increases are being driven by rebates and discounts demanded by third-party payers for allowing drug coverage or preferential access,” explained Dr Vogenberg. “Without addressing the middlemen in the supply chain there is little chance to have meaningful change.”