The Return of Association Health Plans

Last summer’s unsuccessful attempt by Congressional Republicans to repeal the Affordable Care Act (ACA) seems like ancient history, in light of the GOP’s passage of a sweeping tax reform package—which ultimately did repeal the ACA’s individual mandate.

Still, the ACA remains the law of the land, and continues to be a polarizing issue. On one hand, proponents point to the falling number of uninsured individuals, thanks largely to Medicaid expansion and subsidized coverage for those who qualify. On the other hand, opponents say the government is overreaching and not allowing the market to work on its own. Meanwhile, costs for individual plans on the ACA exchange are skyrocketing for many who do not qualify for subsidies, making individual insurance a burden.

With Congress unlikely to make any substantial changes to the US health care system in the coming months, for now, Americans are left with a limping system that has had major chunks cut out of it.

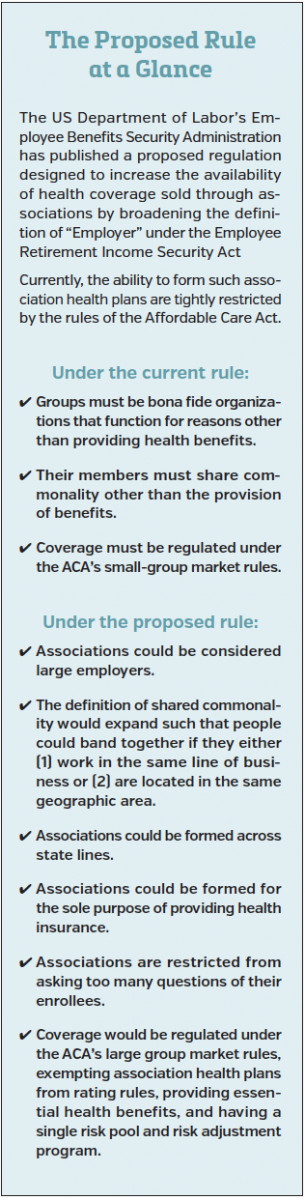

Critics believe that one of those so-called cuts was administered on January 4, 2018 in the form of a proposed rule that would alter the regulation of association health plans. The proposal came on the heels of the President’s executive order to allow more employers to form association health plans. While the details are somewhat complicated (see table), the bottom line is that the rule would allow more association health plans to bypass ACA requirements tied to preexisting condition protections, essential health benefits, and community rating rules. The rule also allows health insurance to be sold across state lines.

The Trump administration says this is good news for people who cannot afford ACA exchange plans, or who cannot find coverage choices where they live. However, skeptics believe that it has the potential to cause unbalanced insurance pools, leaving only older and sicker patients in plans bound by the ACA’s standards.

First Report Managed Care asked experts how the Administration’s move will impact the ACA; whether association health plans—despite their checkered past—have upside; and what if anything payers should be doing now in light of the proposal.

Daniel Sontupe, executive vice president and director of market access & payer marketing at The Bloc Value Builders in New York, said he believes that the move “sends a message to the community that we are going backwards in health care.” He noted that while the ACA is flawed, overall it is moving health care towards a value-based system. The executive order, however, “makes a ‘healthy-person’ plan available,” which is not how insurance is designed to function.

As it is, “ACA plans experience a good deal of negative selection; this may hasten that process,” added Gary Owens, MD, president of Gary Owens Associates.

No Big Deal?

F Randy Vogenberg, PhD, RPh, principal of the Institute for Integrated Healthcare, said that while he sees how such plans can undermine the ACA “to a certain extent,” he also wonders if the issue is being blown out of proportion.

“Overall, association health plans can make sense for low-middle income workers or business,” he said. “As it stands right now, at a very early stage, association health plans are worth taking a look at for those caught between fewer choices or no options, for small businesses that may not have good choices or affordable options post-ACA, and for independent contractors and single persons who have had little to no choice on coverage or affordability.”

Melissa Andel, a health policy director at Applied Policy in Washington, DC, said that she agrees.

“It seems that [association health plans] are a solution to a narrow problem and will have a limited impact on the broader insurance risk pool,” she said. “Perhaps in some localities or states a successful association health plan will be able to draw away enough healthy customers looking for lower premiums, but I don’t see it being big enough to totally undermine the market at large.”

Ms Andel explained that association health plans are unlikely to have a huge impact, simply because despite the bad press ACA plans get, customers prefer the extra protection’s offered under those plans.

“Consumers have shown that—despite their complaints—they like the additional protections and benefits that association health plans will likely have to abandon in order to offer lower prices,” she said. “The elements of the ACA that people like—guaranteed issue, community rating, annual spending caps—are also the elements that drive up the price of insurance. It isn’t clear yet that large number of people are willing to give up those benefits in exchange for lower premiums.”

When viewed through that prism, said Dr Vogenberg, association health plans may be nothing more than “a coverage option [selected by] those willing to purchase them.”

A Checkered Past

The bigger issue with association health plans may be their potential to defraud uninformed consumers. In order to combat widespread fraud, Congress amended the law to give states regulatory authority over association health plans, in most cases requiring licensure and financial reporting. While the states have fared better at regulating association health plans, fraud remains an issue. The ACA then stepped in with the essential health benefits and community rating standards—largely impacting the prevalence of these plans.

The Administration’s proposed rule acknowledges this complicated history by stating that in the past some association health plans have “failed to pay promised health benefits to sick and injured workers while diverting… employer and employee contributions from their intended purpose.” It goes on to note that more government oversight might be required to discourage and weed out such abuse.

Whether such oversight comes to fruition is anyone’s guess, explained Barney Spivack, MD, the national medical director of Medicare case & condition management at OptumHealth.

“The Administration has repeatedly indicated that it is interested in relaxing regulations and eliminating red tape,” he said.

If it takes that approach with association health plans, “consumers will not have the [same] protections [that are] built into the plans sold on the exchanges.” Dr Spivack also said he fears that many consumers will opt for the least expensive coverage. But eventually they “may discover that the association health plans are not able to meet their needs.”

Mr Sontupe noted that a consumer may be under the impression that an association health plan covers cancer treatment, when in reality it covers only cancer diagnosis.

“They may not fully grasp how insurance works, or understand the hidden challenges in the fine print,” he said.

The sketchy history of association health plans is certainly worth noting, particularly when considering their potential negative impact on individual consumers.

However, Ms Andel returns to the fact that association health plans are not likely to disrupt the market all that much.

“Association health plans were not successful in the past. It is unclear what about the market will change fundamentally to address the problems that prevented them from succeeding previously,” she said.

Coverage that FillS in the Gaps?

Dr Vogenberg explained that the value of association health plans could be in their ability to increase coverage numbers and enroll people who currently do not have coverage.

“They are a valuable alternative for coverage, and could actually expand the number of covered individuals,” he said.

“Without a doubt they could expand choice and offer avenues to coverage for [some] who would otherwise go without it,” Ms Andel added. But she quickly noted that association health plans are not the sole answer. “People go without health insurance for many reasons, and it doesn’t seem as if association health plans are designed to address all of those reasons.”

Dr Spivack echoed that sentiment. “My sense is that many of those who took a chance and did not purchase exchange plans will also not purchase these plans.”

Dr Owens said that, for many, the decision will be based on simple math. “Coverage will expand to those who find that [buying it] is a better option than paying the [ACA] penalty.”

Mr Sontupe said that, in theory, he likes the concept of increasing competition by selling plans across state lines, “as long as all plans are held to the same standard.” But the administration’s move would not create a level playing field, and Trump’s promise to offer more strict oversight is being met with skepticism.

Dr Owens said he doubts that the federal government is interested in regulatory review, and he worries that states will be in over their heads if asked to regulate plans that can be sold in multiple states.

Ms Andel agreed with that lack of oversight could be a huge issue.

“Stricter oversight would definitely help, but from where? States? The Trump administration? States have historically regulated insurance products, but it seems that the Administration is unlikely to enforce strict oversight of association health plans, especially since it is touting them as providing more affordable alternative coverage options,” she said.

How Should Payers Prepare for this Comeback?

Meanwhile, insurance organizations and payers have registered their concerns about association health plans and selling plans across state lines.

The latest statement comes from the American Academy of Actuaries, which in late January called on policymakers to fully understand “potential solvency and adverse selection concerns” before proceeding.

If that advice falls on deaf ears, how should payers prepare? Our experts said they believe it is business as usual.

“Payers can offer this [service] as part of their usual business process,” Dr Owens explained.

Insurers will not take on risk, but will instead develop plans and process claims, noted Mr Sontupe. “For organizations that are well run, this is an opportunity to create additional products that drive revenue and reduce risk.”

Dr Spivack said payers are used to finding ways to do more with less, which might prove beneficial to association health plans. Insurers “have teamed with hospitals and heath networks to create new models and use their extensive resources more wisely.”

These efforts resulted in plans “that are much more competitive, but still maintain the basic benefits and protections that consumers want,” he said.

Ms Andel said that payers have an opportunity to not only protect consumers, but teach them as well.

“Education and outreach will be really important, so that Americans can make truly informed decisions on which plan to pick, or whether they should go uninsured,” she said.

This will be particularly crucial once the individual mandate expires in 2019.

“Payers could help [with this], but they need to [make sure] that their messages aren’t misleading or otherwise self-serving.”

For articles by First Report Managed Care, click here

To view the First Report Managed Care print issue, click here