Generics From Abroad: A solution for drug price gouging?

Generic medications currently make up nearly 4 out of 5 prescriptions filled in the United States health care system, according to the CDC. While they are viewed as one of the most crucial means of saving consumers and taxpayers billions of dollars, prices of some generic treatments have risen and in some cases skyrocketed in recent years.

Generic medications currently make up nearly 4 out of 5 prescriptions filled in the United States health care system, according to the CDC. While they are viewed as one of the most crucial means of saving consumers and taxpayers billions of dollars, prices of some generic treatments have risen and in some cases skyrocketed in recent years.

Between 2010 and 2014, the average price of the 50 most popular generic drugs increased 373%, according to OptumRx. As payers, prescribers, patients, and policymakers have cried foul, drugmakers have pointed to a whole range of factors, such as industry consolidation and FDA-mandated plant closures to explain away the cost hikes.

However, a complaint filed in December by 20 states alleges collusion among generic drug competitors is behind these price increases. The suit indicates that in some cases generic drugmakers looking to sell a new product seek out rivals to strike up an agreement that will maintain market share and avoid price battles, a practice that artificially preserves high rates while creating the appearance of competition.

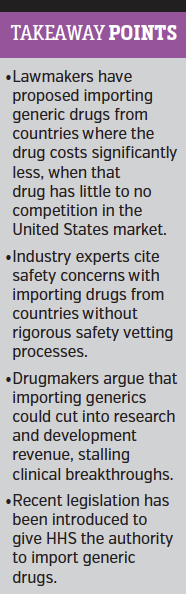

It is, of course, just one recent development in an ongoing battle. As the search for ways to deal with drug cost increases continues, a variety of proposals have been brought forth, including implementing price regulation, giving CMS the authority to negotiate prices on behalf of Medicare beneficiaries, or even importing drugs from other countries.

Importation is an idea that has been backed by President Trump, the American public, and Democrats. According to the Kaiser Family Foundation, 72% of Americans favor buying prescription drugs imported from Canada, and a federal budget amendment that would legalize the importation of foreign prescription drugs from Canada and other countries was recently introduced by Sen Bernie Sanders (D-Vermont).

Despite the bipartisan support for drug price reform, the amendment was not able to gather enough votes to pass in the Senate vote held on January 11, but the political fervor present on both sides of the aisle could continue to force the issue.

Both Sides of the Debate

While relaxing importation laws would inject competition into the system and help reduce prices, it is a contentious proposal in large part because of safety concerns, explained Joshua P Cohen, PhD, research associate professor at the Tufts Center for the Study of Drug Development (CSDD).

Safety is a legitimate concern because not all international markets are subject to the same type of regulatory safety and efficacy standards that are imposed by the FDA, but Canada, Israel, Japan, Australia, and a number of European countries do have similar regulatory bodies. Those who have an issue with importation from these countries, he said, may have a pro-industry bias.

It is the size and scope of any importation proposals that make the biggest difference, agreed Gary Young, JD, PhD, director of Northeastern University’s Center for Health Policy and Healthcare Research. Bringing drugs in from Canada, for example, is a much different scenario than allowing importation from any country across the globe.

Either way, it could be a slippery slope, he warned, and if importation were pursued and Americans happened to be badly harmed by drugs from abroad, patients would likely look to the FDA and wonder why they weren’t better protected.

“People want these kinds of freedoms,” he said, “but then when tragedy strikes they ask why there wasn’t more regulation.”

In addition to safety considerations, those opposed to importation argue that drug development is an important piece of the discussion. At least part of the reason for lower drug costs abroad relates to the ability of some governments to directly negotiate with pharmaceutical companies, but importing foreign medicines could essentially import foreign price controls—a dynamic that would force drug developers to scale back on research.

Creating a new pharmaceutical product costs $2.6 billion on average, according to the Tufts CSDD. There is a need to be able to sell enough of their successes to cover all the failed attempts, manufacturers argue, and product prices reflect the reality that most drugs never make it to market. There is some validity to this argument, Dr Young noted.

“In the past, and it’s still largely true, US drug manufacturers have been the engine of drug innovation,” he said, “That has carried the weight of R&D investment for the rest of the world.”

The Broader Picture

“How it plays out is going to depend on what we end up doing with health care reform, or the dismantling of health care reform,” Dr Young predicted. “I don’t think you’re going to see anything major occurring right now around drug prices.”

In the meantime, he believes policymakers will keep an eye on the market, and if costs continue to rise rapidly importation could be brought back for consideration.

“If they want to do something about it and there’s bipartisan support I could foresee the passage of legislation which would allow for importation of generic products at least from certain markets,” Dr Cohen said. In the immediate future, however, he said that there is a different solution that is more likely to take hold.

The FDA does not spend as much time on generics as it could, he explained. Traditionally, the focus has been geared toward new and innovative drugs. Because of this, there are some areas where there have not been enough generic products pushed through the approval process. It is a problem that could potentially be addressed with added FDA resources.

“I think that will happen in the short term,” he added. “In fact, I think that will happen within the next 100 days because there’s a backlog of generics that are in the approval process and if you can streamline that process, get rid of the backlog, and make sure there are products on the market you’re going to lower prices or at least provide competition, which should lower prices.”

However, drug pricing is incredibly complex—and even if a measure like importing from abroad were implemented, there are no guarantees that there would be a drop-off in price, Dr Cohen cautioned. He also expressed doubt that the drop would be large enough to resolve some of the high-profile cases.

“And I think that’s what the politicians are saying, too,” he said. “They’re okay with these companies like Mylan and others making money. I don’t think that’s the issue. The issue is, is it egregious? Are they misusing their position and making it into a monopoly position when it’s supposed to be a generic market for that product?”

“I think from a company’s perspective, Mylan would tell you that EpiPen at $600 a piece provides value to patients and probably does,” Dr Cohen added, “but value is defined differently depending on the perspective, whether it’s Mylan making that judgement or the patient making that judgement or a doctor or society or government.”

Government programs like Medicare, Medicaid, and the Department of Veterans Affairs make use of public money and some of that is being spent on very high-priced generic drugs, and as a result politicians are questioning whether we are getting value for that money. This is a discussion that goes well beyond generics into branded drugs and health care in general.

“Clearly for the industry it’s about profit, and it makes sense, but if they are egregious in their pricing practices it forces premiums to go up,” Dr Cohen concluded. Patients have to pay more out of pocket, providers are subject to added financial risk, hospitals have to spend more, and that’s where the whole value discussion comes in.

Meanwhile, on January 23, Sen Amy Klobuchar (D-Minnesota) and Sen Mike Lee (R-Utah) introduced bipartisan legislation that would allow for the HHS secretary to authorize importation of generics that have been on the market for at least 10 years when there are fewer than five competitors.

““If drug companies think new competitors can quickly enter the market, maybe they’ll think twice before raising prices in the first place,” Sen Klobuchar said. “Injecting more competition into the marketplace will lead to more affordable prescription drugs for American consumers.”